When it comes time to purchase a new home, your mortgage strategy will likely depend on the stage of life you are in. Early-career home buyers (Millennials) have just entered the workforce so they usually have little cash and may be in debt. Gen X home buyers are busy trying to advance their careers, raise families and save for retirement. Baby boomers have often left the workforce, so they have less income and may already be spending their retirement savings. Each of these life stages present unique challenges that call for a different mortgage strategy. Here are some tips to

Read More

Archives for Buyers

How Important Is Home Staging?

Because the Internet has changed the way we buy and sell homes, most real estate professionals believe home staging is critical to selling success. Almost all home buyers begin their search online meaning sellers need to make a good first impression so potential buyers want to see their home in person. Hence, staging has taken the residential real estate industry by storm and many sellers are hiring professionals to help them make that first impression. National Association of Realtors (NAR) President Chris Polychron says “staging is an excellent tool that can be used to give a home a little extra

Read More

Buying Old Versus New Properties – Pros and Cons

When buying any commodity, new is often better than used. In the housing market, though, your best opportunity can come from an old home or, as in Ottawa, where the inventory of new homes is overstocked, you may be able to purchase a new home for the same price buyers paid years ago. Here are some advantages and risks of both options. Advantages of Buying Old Properties you can physically walk through and inspect the home similar listings have sold or are currently available to use for comparative market analysis when establishing price antique homes appeal to a

Read More

Why Appreciate Your Real Estate Agent

When you decide to buy your first home, the initial excitement is often quickly followed by fear of the unknown. After viewing many attractive properties online, you have no idea where to start. Eventually, though, with the invaluable assistance of a real estate agent, you can purchased your dream home at a great price. Those who have experienced a number of property transactions realize just how many reasons they have to be thankful for the trusting relationship they developed with their agent. First, the money and time you save far exceeds the agent’s commission. From planting the For

Read More

Financing Your Home Purchase – Mortgage Broker or Bank?

When it comes time to purchase a new home, where should you go for financing? You may have a relationship with a bank from past transactions (RRSPs, savings accounts, car loan), so it’s the first option that comes to mind. But, mortgage brokers are licensed specialists who have access to many lenders and mortgage rates, so they may be a better choice. Here are some pros and cons for each. Advantages of Mortgage Brokers do all the negotiating for you to find the lowest rate have knowledge of, and access to, the entire mortgage market have exclusive

Read More

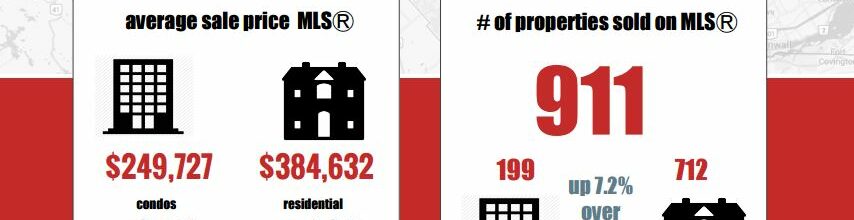

Real Estate Snapshot February 2016

What a difference a day makes! An extra day in February saw 46 sales on that day (February 29th) as per the Ottawa Real Estate Board’s news release March 3rd. See the full Ottawa Real Estate market snapshot for February and the full story from the Ottawa Real Estate Board below. With spring around the corner, we’re starting to see more homes come on the market, if you’re thinking of selling now is a great time to get your home listed with a real estate professional. While statistics are useful in establishing trends they should not be used as

Read More

Saving Strategies for Every Age

We all want to save more money, but doing it requires a plan. And, the best approach to saving depends on the stage of life you’re in because each phase has unique financial commitments. Although individual circumstances vary, these generation-specific suggestions will point you in the right direction. Millennials (19-35) Millennials, born between 1980 and 1996, are actually better than Gen Xers at money management, according to financial journalist Vera Gibbons. But, they tend to live in the moment and prefer instant gratification to long-term financial planning. And, because personal finance is not a core subject in

Read More

Don't tax my dream campaign succeeds

The efforts of the Ontario Real Estate Association (OREA) and the Progressive Conservatives were recently rewarded when the provincial government decided they would NOT be expanding the municipal land transfer tax program. Liberals keep election promise In an unexpected announcement during the legislature’s question period, Municipal Affairs Minister Ted McMeekin ended concerns that the Liberals would break their election campaign promise and allow other cities and towns to introduce the tax. “There has been no call, at all, for a municipal land transfer tax,” he said, “nor is there any legislation before the House that would

Read More

8 steps to getting started in property investment

This propertyinvestment.com post from Nila Sweeney is an excellent primer for those who want to start a property portfolio. First, check your finances to see how much you can invest and get mortgage pre-approval. Then, define what success means for you, as well as the level of risk you are comfortable with, and set your goals. Next, start budgeting and create a purchase plan. Finally, research the market for opportunities that meet your criteria and approach them as business transactions, applying logic rather than being swayed by your emotional attachment. To read more click here. Source: Blog

Read More

An Economist’s Letter to Millennials Who Can’t (Yet) Buy a Home

This post from Jonathan Smoke, chief economist at realtor.com, explains what Millenials can do to help themselves along the path to home ownership. For example, a high debt burden will restrict their ability to qualify for a mortgage, and the amount they can get, so they need to limit their total debt payments (student loans, credit cards, car loans, etc.) to less than 15% of their income. Smoke also covers the importance of improving their credit score, saving as much as they can for a down payment and creating an emergency fund for unexpected bills. To read more click here.

Read More